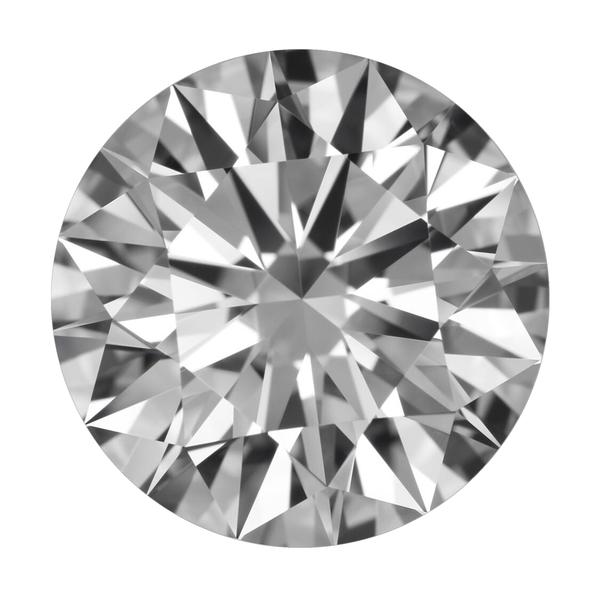

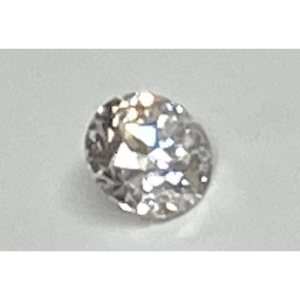

INVESTMENT DIAMOND | 9,75 CT.

- Quantity: 1

- Carat: 9.75

- Color: D (River) Exceptional White +

- Clarity: Flawless

- Cut: Excellent

- Polish: Excellent

- Symmetry: Excellent

- Certificate: GIA-Certificate

To invent in diamonds.

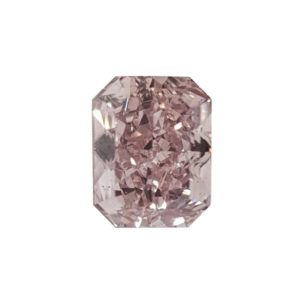

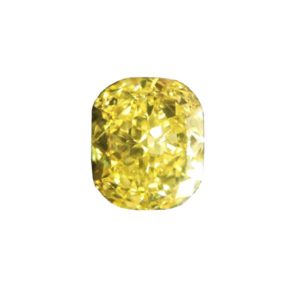

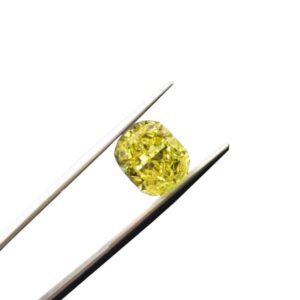

For centuries, people have turned to diamonds as a method of wealth condensation and wealth transportation. However, in the last few decades, as the popularity of certain diamonds has significantly increased and education about their investment benefits better known, the concept of diamonds as an investment has arisen in a big way. The most notable has been the big-ticket fancy color diamonds that are sold by auction houses such as Sotheby’s and Christie’s. These diamonds time and again earn incredible prices per carat at auction, shattering previously set records and continually gaining in value and helping increase overall value for stones of those colors in the market as a whole.

One of the great benefits of privately owning an investment diamond is the control of the diamond in its entirety. That means that you alone will control when it will be resold, if at all, which allows you the freedom of passing it on as a heritage, and the security that as a universal asset worldwide, it will always be redeemable for its true value regardless of where it is ultimately resold. This fact is very appealing and a big draw for private diamond investments.

Please notice: Pricing on any loose diamond may vary based on market availability and the diamond specification. All diamonds are unique.

Reviews

There are no reviews yet.